Class 12 Accountancy Sample Paper Set A

Please see below Class 12 Accountancy Sample Paper Set A with solutions. We have provided Class 12 Accountancy Sample Papers with solutions designed by accountancy teachers for Class 12 based on the latest examination pattern issued by CBSE. We have provided the following sample paper for Class 12 Accountancy with answers. You will be able to understand the type of questions which can come in the upcoming exams.

CBSE Sample Paper for Class 12 Accountancy Set A

Part- A

1. If the Partners’ Capital Accounts are fixed ‘salary payable to partner’ will be recorded :

(A) On the debit side of Partners’ Current Account

(B) On the debit side of Partners’ Capital Account

(C) On the credit side of Partners’ Current Account

(D) None of the above

Answer: On the credit side of Partners’ Current Account

2. A and B are partners in a firm sharing profits and losses in the ratio of 3: 2. A new partner C is admitted. A surrenders 1/15th share of his profit in favour of C and B surrenders 2/15th of his share in favour of C. The new ratio will be :

(A) 8 : 4 : 3

(B) 42 : 26 : 7

(C) 4 : 8 : 3

(D) 26 : 42 : 7

Answer: 42 : 26 : 7

3. Reserve Capital is also known by :

(A) Capital Reserve

(B) Called up Capital

(C) Subscribed Capital

(D) None of the above

Answer: None of the above

4. Salary paid in cash during the current year was Rs.30,000; Outstanding salary at the end of previous year was Rs.2,000 and outstanding salary at the end of current year was Rs.3,000. Salary paid in advance during current year for next year was Rs.2,600. The amount debited to Income and Expenditure Account will be :

(A) Rs.33,600

(B) Rs. 26,400

(C) Rs.31,600

(D) Rs.28,400

Answer: Rs.28,400

5. On taking responsibility of payment of a liability of Rs.50,000 by a partner, the account credited will be :

(A) Realization Account

(B) Cash Account

(C) Capital Account of the Partner

(D) Liability Account

Answer: Capital Account of the Partner

6. If a share of Rs. 10 on which Rs.8 has been called and Rs. 6 is paid is forfeited, the Share Capital Account should be debited with :

(A) Rs. 8

(B) Rs. 10

(C) Rs. 6

(D) Rs. 2

Answer: Rs. 8

7. On dissolution of a firm, its Balance Sheet revealed total creditors Rs.50,000; Total Capital Rs.48,000; Cash Balance Rs.3,000. Its assets were realized at 12% less. Loss on realization will be :

(A) Rs.6,000

(B) Rs.11,760

(C) Rs.11,400

(D) Rs.3,600

Answer: Rs.11,400

8. Goodwill of a firm of A and B is valued at Rs.30,000. It is appearing in the books at Rs.12,000. C is admitted for 1/4 share. What amount he is supposed to bring for goodwill?

(A) Rs.3,000

(B) Rs.4,500

(C) Rs.7,500

(D) Rs.10,500

Answer: Rs.7,500

9. A, B and C are partners in a firm whose books are closed on 31st March each year. B died on 30th June, 2009 and according to the agreement, the share of profit of a deceased partner up to the date of the death is to be calculated on the basis of the average profits for the last five years. The net profits for the last 5 years have been 2005: Rs. 14,000; 2006: Rs. 18,000; 2007: Rs. 16,000; 2008: Rs. 10,000 (loss) and 2009: Rs. 16,000. B’s share of profits up to the date of death will be Rs……………

Answer: B’s share of profit will be Rs. 900

10. A, B, and C are partners with profit sharing ratio 4:3:2. B retires and goodwill was valued Rs.1,08,000. If A and C share profits in 5:3, the amount of goodwill shared by A and C in favour of B will be Rs.19,500 by A and Rs…………by C.

Answer: Rs. 16,500 by C

11. Capital invested in a firm is Rs. 3,00,000. Normal rate of return is 10%.Average profits of the firm are Rs. 41,000 (after an abnormal loss of Rs. 2,000).The goodwill of the firm at five times the super profit will be…

(A)Rs. 75,000

(B)Rs. 65,000

(C)Rs. 55,000

(D)Rs.45,000

Answer: Goodwill Rs. 65,000

12. On 1st January 2019, a partner advanced a loan of Rs.1,00,000 to the firm. In the absence of agreement, interest on loan on 31st March 2019 will be :

(A) Nil

(B) Rs.1,500

(C) Rs.3,000

(D) Rs.6,000

Answer: Rs.1,500

13. A and B are partners. According to Profit and Loss Account, the net profit for the year is Rs.2,00,000. The total interest on partner’s drawings is Rs.1,000. As salary is Rs.40,000 per year and B’s salary is Rs.3,000 per month. The net profit as per Profit and Loss Appropriation Account will be : (A) Rs.1,23,000

(B) Rs.1,25,000

(C) Rs.1,56,000

(D) Rs.1,58,000

Answer: Rs.1,25,000

14. From the following information calculate the amount of subscriptions to be credited to the Income and Expenditures Account for the year 2016-17:

Answer: Subscriptions to be credited to Income and Expenditures Account- Rs. 65,000

(OR)

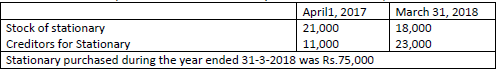

On the basis of the information given below calculate the amount of Stationary to be debited to the ‘Income and Expenditures Account ‘for the year ended 31st March, 2018:

Answer: Income and expenditures Account

(for the year ending 31st March, 2018)

15. Ram, Shyam and Mohan are partners in a firm sharing profits and losses in the ratio of 2:1:2. Their fixed capitals were Rs. 3,00,000, Rs. 1,00,000 and Rs. 2,00,000 respectively. Interest on capital for the year ended 31st March, 2018 was credited to them @ 9% p.a. instead of 10% p.a. The profit for the year before charging interest was Rs. 2,50,000. Prepare necessary adjustment entry.

Answer: Shyam’s Current A/c……………Dr. 200

Mohan’s Current A/c……………Dr.400

To Ram’s Current A/c 600

(OR)

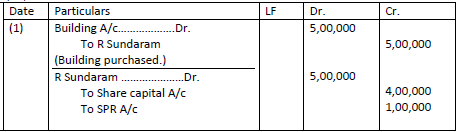

16.Pass necessary journal entries for the followings:

(i) X Ltd. purchased land and building from R. Sundaram for Rs. 5,00,000 Payable in fully paid up shares of Rs. 100 each at a premium of 25%.

(ii) Y Ltd. decided to issue 2,000 shares of Rs. 100 each to Unit Trust of India as underwriting commission.

Answer:

17. Pass necessary Journal entries on the dissolution of firm.

(i) Dissolution expenses Rs. 8,000 were paid by the partner, M.

(ii) Dissolution expenses were Rs. 5,000.

(iii) P, a partner, was appointed to look after the process of dissolution for which he was allowed a remuneration of Rs. 7,000. P agreed to bear the dissolution expenses. Actual dissolution expenses Rs. 4,000 were paid by P.

(iv)N, a partner, was appointed to look after the process of dissolution for which he was allowed a remuneration of Rs. 9,000. N agreed to bear the dissolution expenses. Actual expenses Rs. 4,000 were paid by the firm.

Answer: (i) Realization A/c………..Dr 8,000

To M’s Capital A/c 8,000

(ii) Realization A/c………..Dr. 5,000

To Cash A/c 5,000

(iii) Realization A/c………Dr. 7,000

To P’s capital A/c 7,000

(iv) Realization A/c………Dr. 9,000

To Cash A/c 4,000

To N’s Capital A/c 5,000

18. Manoj and Nand were partners sharing profits in the ratio of 3:2. Pass necessary journal entries under the following situations-

1. WCR stood at Rs. 1,00,000 and there was no liability in respect of it.

2. WCR stood at Rs. 1,00,000 and liability in respect of it was Rs. 75,000.

3. WCR stood at Rs. 1,00,000 and liability in respect of it was Rs. 1,20,000.

4. WCR stood at Rs. 1,00,000 and liability in respect of it was Rs. 1,00,000.

Answer: (1) WCR A/c……………..Dr. 1,00,000

To Manoj 60,000

To Nand 40,000

(2) WCR A/c……………..Dr. 1,00,000

To Realization A/c 75,000

To Manoj 15,000

To Nand 10,000

(3) WCR A/c……………Dr. 1,00,000

To Realization A/c 1,00,000

(4) WCR A/c……………Dr. 1,00,000

To Realization A/c 1,00,000

19. Following is the Receipts and Payments Account of Literacy Club for the year ended 31-3-2016:

Additional Information:

(i) Subscriptions outstanding as on 31-3-2015 were Rs. 2,000 and on 31-3-2016 Rs. 2,500.

(ii) On 31-3-2016 salary outstanding was Rs. 600 and rent outstanding was Rs. 1,200.

(iii) The Club owned furniture Rs. 15,000 and Books Rs. 7,000 on 1-4-2015.

Prepare Income and Expenditures Account of the Club for the year ended 31-3-2016.

Answer: Subscriptions credited to Income and Expenditures Account- Rs. 28,200.

Accrued interest on Fixed deposit- Rs. 900.

Excess of Income over Expenditures- Rs. 24,850.

20. (A) Give journal entries in each of the following cases:

(i) A Debenture issued at 105 and repayable at 100.

(ii) A Debenture issued at 100 and repayable at 105.

(iii)A Debenture issued at 110 and repayable at 105.

(iv) A Debenture issued at 95 and repayable at 110.

Answer: 1.5 marks for each condition.

21. A and B shares the profits of a business in the ratio of 5:3. They admit C, into the firm for 1/4 th share in the profits to be contributed equally by A and B. On the date of admission of C, the Balance Sheet of the firm was as follows:

The terms of C’s admission were as follows:

(i) C will bring Rs. 30,000 for his share of capital and goodwill.

(ii) Goodwill of the firm has been valued at 3 years purchase of average super profit of last four years. Average profit of last four years is Rs. 20,000 while the normal profits that can be earned with the capital employed are Rs. 12,000.

(iii) Furniture is undervalued by Rs. 12,000 and the value of stock is reduced to Rs. 13,000. Provident Fund be raised by Rs. 1,000.

(iv) Creditors are unrecorded to the extent of Rs. 6,000.

Prepare Revaluation Account and Partners Capital Account of the firm.

Answer: Amount of Goodwill = Rs. 24,000 (1 mark)

C’s share of goodwill = Rs. 6,000

Profit on Revaluation- Rs. 3,000 (3 marks)

Partners Capital Accounts- A- Rs. 47,375, B- Rs. 35,625, C- Rs. 24,000

(OR)

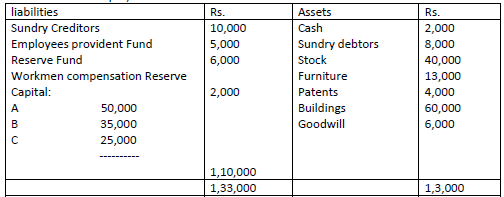

A, B and C were partners sharing profits and losses in the ratio of 5:3:2. Their Balance Sheet as at 1st April, 2018 was as follows:

C retires on above date and the partners agreed that:

(i) Goodwill of the firm be valued at Rs. 20,000.

(ii) 5% provision for doubtful debts to be made on debtors.

(iii) Stock be appreciated by 10%

(iv) Patents are valueless.

(v) Building be appreciated by 20%.

(vi) Sundry Creditors to be paid Rs. 2,000 more than the book value.

Pass necessary journal entries in the books of the firm.

Answer: (i) Reserve Fund ……Dr. 6,000

To A’s capital A/c 3,000

To B’s Capital A/c 1,800

To C’s capital A/c 1,200

(ii) WCR A/c……….Dr. 2,000

To A’s capital A/c 1,000

To B’s Capital A/c 600

(iii) Revaluation A/c………Dr. 6,400

To Prov. for doubtful debts A/c 400

To patents 4,000

To Creditors 2,000

(iv) Stock…………Dr. 4,000

Building…….Dr.12,000

To Revaluation A/c 16,000

(v) Revaluation A/c……Dr. 9,600

To A’s capital A/c 4,800

To B’s Capital A/c 2,880

To C’s capital A/c 1,920

(vi) A’s capital A/c..Dr.3,000

B’s capital A/c…Dr.1,800

C’s Capital A/c…Dr. 1,200

To Goodwill A/c 6,000

(vii) A’s Capital A/c….Dr.2,500

B’s Capital A/c….Dr 1,500

To C’s Capital A/c 4,000

(viii) C’s Capital A/c……Dr. 31,320

To C’s Loan A/c 31,320

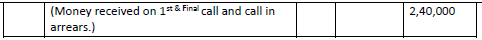

22. Jaya Ltd issued 60,000 shares of Rs 10 each at a premium of Rs 2 per share payable as Rs 3 on application, Rs 5 (including premium) on allotment and balance on the first and final call. Applications were received for 82,000 shares. The directors resolved to allot as follows

(i)Applicants of 30,000 shares — allotted 20,000 shares

(ii)Applicants of 50,000 shares — allotted 40,000 shares

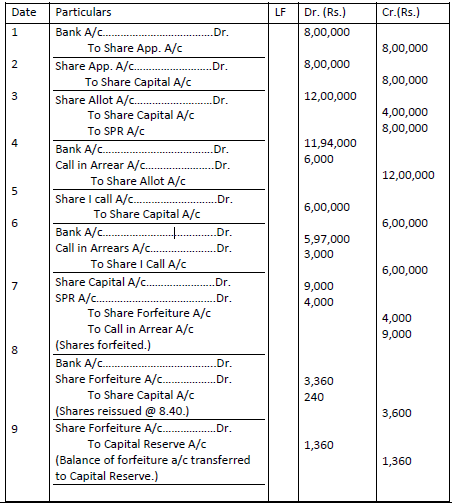

(iii)Applicants of 2,000 shares — Nil Ramesh who had applied for 900 shares in category (i) and Suresh who was allotted 600 shares in category (ii) failed to pay the allotment money. Pass necessary journal entries in the books of Jaya Ltd.

Answer:

(OR)

X Ltd. issued a prospectus offering 2,00,000 shares of Rs. 10 each at Rs. 14 per share payable as follows: On application- Rs.4 On allotment- Rs. 6 (including premium Rs. 4) On first call- Rs.3 On final call- balance Dinesh the holder of 1,000 shares did not pay the amount due on allotment and first call. His shares were forfeited and 400 of these shares were immediately reissued credited Rs. 9 paid for Rs. 8.40 per share. Final call was made afterwards and it was duly received.

Pass necessary journal entries in the books of company.

of company.

Answer:

Part – B

23. If the amount of goodwill is Rs.40,000 at the beginning of a year and Rs.48,000 at the end of that year then while preparing cash flow statement its effect on cash flow will be-

(A) Cash used (Payment) in Investing Activities Rs.8,000

(B) Cash received from operating activities Rs.8,000

(C) Cash used (Payment) from Operating Activities Rs.8,000

(D) Cash used (Payment) from Financial Activities Rs.8,000

Answer: Cash used (Payment) in Investing Activities Rs.8,000

24. What will be the impact of ‘Cash Paid to Trade payables’ on a Current Ratio of 1:1?

Answer: Current ratio will remain same as the Current Assets and Current liabilities will be decreased by same amount.

25. 50,000, 9% Debentures redeemable within 12 months of the date of Balance Sheet will be shown under :

(A) Short-term Borrowings

(B) Short-term Provision

(C) Other Current Liability

(D) Trade Payables

Answer: Other Current Liability

26. An example of cash flow from operating activity is :

(A) Purchase of own debenture

(B) Sale of fixed assets.

(C) Interest paid on term-deposits by a bank

(D) Issue of equity share capital

Answer: Interest paid on term-deposits by a bank

27. While preparing a balance Sheet, proposed dividend for current year will be shown under the head……………….

Answer: Contingent Liabilities

28. Debt Equity ratio of a company is 1:2. Which of the following transactions will increase it?

(A)Issue of new shares for cash

(B)Redemption of Debentures

(C)Issue of Debentures for cash

(D)Goods purchased on credit

Answer: Issue of Debentures for cash

29. A Company’s liquid assets are Rs.10,00,000 and its current liabilities are Rs.8,00,000. Subsequently, it purchased goods for Rs.1,00,000 on credit. Quick ratio will be-

(A) 1.11 : 1

(B) 1.22 : 1

(C) 1.38 : 1

(D) 1.25 : 1

Answer: 1.11 : 1

30. Calculate Inventory Turnover Ratio from the followings- Opening Inventory- Rs. 42,500

Closing Inventory- Rs. 37,500

Revenue from Operations (Sales)- Rs. 3,00,000

Gross Profit 20% on cost.

Answer: Inventory Turnover Ratio- 6.25 times

(OR)

Calculate Gross Profit Ratio from the followings-

Answer: Gross Profit ratio- 22%

31. Prepare a Comparative Statement of Profit & Loss from the following information.

Answer: Revenue from Operation- 150%, Cost of material consumed- 100%, Other expenses- 300%, Total Expenses- 118.18%, Profit before tax- 500%, Profit after Tax- 500%.

(OR)

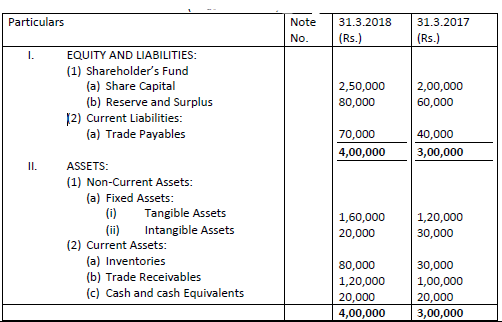

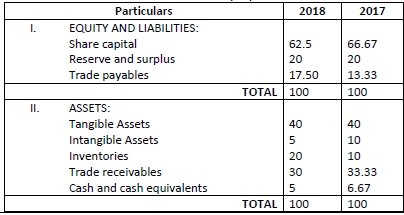

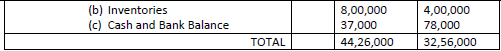

From the following Balance Sheet, prepare a Common Size statement:

BALANCE SHEET

(as at 31st March, 2018)

Answer:

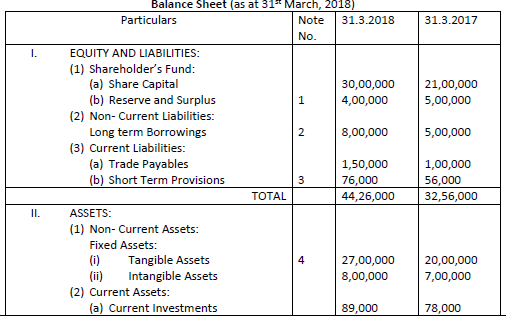

32. From the following Balance Sheet and the additional information as at 31st March, 2018 prepare a Cash Flow Statement:

NOTES TO ACCOUNT:

Additional Informations:

(i) During the year a machinery costing Rs. 8,00,000 on which accumulated depreciation was Rs. 3,20,000 was sold for Rs. 6,40,000.

(ii) Debentures were issued on 1st April, 2017.

Answer: Cash used in Operating Activities- Rs. (1,06,000)

Net cash used in Investing Activities- Rs. (10,60,000)

Cash inflows from Financing Activities- Rs. 11,36,000

Net Profit before tax- Rs. (24,000)