Class 12 Business Studies Sample Paper Term 2 Set C

Please see below Class 12 Business Studies Sample Paper Term 2 Set C with solutions. We have provided Class 12 Business Studies Sample Papers with solutions designed by Business Studies teachers for Class 12 based on the latest examination pattern issued by CBSE. We have provided the following sample paper for Term 2 Class 12 Business Studies with answers. You will be able to understand the type of questions which can come in the upcoming exams.

CBSE Sample Paper for Class 12 Business Studies Term 2 Set C

Short Answer Type Questions – I

1. Identify and explain the step in the process of selection in which certain documents need to be

executed by the employer and the candidate.

Answer. The step in the process of selection in which certain documents need to be executed by the employer and the candidate is Contract of Employment. After the job offer has been made and candidate accepts the offer, certain documents need to be executed by the employer and the candidate. One such document is the attestation form. This form contains certain vital details about the candidate, which are authenticated and attested by him or her. Attestation form will be a valid record for future reference. There is also a need for preparing a contract of employment. Basic information that should be included in a written contract of employment will vary according to the level of the job.

2. Shoaib Ltd. is a company operating in the Dehradun Valley. It deals in exporting ‘Litchis’, a fruit grown on large scale in the Valley. Due to recent floods in the Valley, many problems have arisen for the company. Many workers have been dislocated and trees have been destroyed. The firm is therefore, unable to supply ‘Litchis’. Moreover, the company has to bear the fixed expenses. Thus, it is facing a liquidity crisis. The CEO of the company feels that taking a loan from a commercial bank is the only option to meet its short-term shortage of cash. As a Finance Manager of the company, name and explain the alternative to bank borrowing that the company can use to resolve the crisis.

Answer. The firm can use Commercial Paper instead of borrowing from the bank: Commercial Paper is a short-term unsecured promissory note, negotiable and transferable by endorsement and delivery with a fixed maturity period. It is issued mostly by large and creditworthy organizsations to raise short-term funds at lower rate of interest than market rates. The issuance of commercial paper is an alternative to bank borrowing for large companies that are considered to be financially strong.

3. Name and explain the process that helps in searching for possible candidates for a job or a function.

Answer. Recruitment: Recruitment refers to the process of finding possible candidates for a job or a function. It has been defined as ‘the process of searching for prospective employees and stimulating them to apply for jobs in an organization.’ Advertising is commonly part of the recruitment process, and can occur through several means, e.g., newspapers, using TV programmes dedicated to job advertisement, through professional publication, using advertisements across internet, through a job center, through campus interviews, etc.

4. Sameer Sweets, a renowned name for quality sweets since 1950 had maintained its standards ever since then. It is an ancestral sweet shop and Sana, the present owner of Sameer Sweets, is the third generation entrepreneur who has taken the charge of the sweet shop from her father. Sana has been handling her responsibilities exceptionally well except that she was worried as the sales had declined during the last three months despite her best efforts and involvement in business. When she inquired from the Sales Manager, Ajay, he reported that there were some complaints about the quality of sweets from many customers recently. Identify and explain the step in the process of controlling discussed in the above case.

Answer. The step in the process of controlling discussed is Setting Performance Standards.

Standards are the criteria against which actual performance would be measured. Thus, standards serve as benchmarks towards which an organization strives to work. Standards can be set in both quantitative as well as qualitative terms. For instance, standards set in terms of cost to be incurred, revenue to be earned, product units to be produced and sold, time to be spent in performing a task, all represents quantitative standards. Sometimes, standards may also be set in qualitative terms. Improving goodwill and motivation level of employees are examples of qualitative standards.

Short Answer Type Questions – II

5. Currently as a part of compensation, the employees and employers contribute 12% of basic wages each towards Employees’ Provident Fund Scheme and Employees’ Pension Fund scheme in an organization. A proposal to decrease the contribution by employers and employees to 10% of basic pay and dearness allowance was proposed during a meeting of Employees Provident Fund Organization. The stakeholders expressed their concern about it and they feel that it should remain at 12%. Explain any three needs as suggested by Maslow’s Need Hierarchy Theory, which will not be satisfied by the incentives discussed above.

Answer. The following needs are given as per Maslow’s Need Hierarchy Theory that will not be satisfied by the two incentives- basic pay and allowances (satisfies basic needs) and retirement benefits (satisfy safety and security needs) are as follows:

(i) Affiliation/Belonging Needs: These needs include affection, sense of belongingness, acceptance, approval and friendship or companionship.

(ii) Esteem Needs: These needs refer to factors such as self-respect, independence, status, recognition, appreciation and attention.

(iii) Self-Actualization Needs: It refers to the highest level of need in the hierarchy. It deals with the drive to become what one is capable of becoming by attaining one’s true potential and includes growth, self-fulfillment, etc.

6. Define communication as an element of Directing? Explain the concept of formal communication.

OR

Define directing? Explain how directing initiates action and integrates employees’ efforts in the organization?

Answer. Communication is defined as a process of exchange of ideas, information, views, facts, feelings etc., between or among people to create common understanding. In the words of Louis Allen, “Communication is the sum of all things one person does when he wants to create understanding in the mind of another. It involves systematic and continuous process of telling, listening and understanding”.

Formal Communication: Formal Communication flows through official channels designed as per the organization chart. This communication may flow from a superior to a subordinate or from a subordinate to a superior or among same cadre employees or managers. The communication may be oral or written but is generally recorded and filed in the office.

OR

Directing refers to the process of instructing, guiding, counselling, motivating and leading people in the organization to achieve its objectives.

Directing initiates action: Directing helps to initiate action by people in the organization towards attainment of desired objectives. For example, if a supervisor guides his subordinates and clarifies

their doubts in performing a task, it will help the worker to achieve work targets given to him.

Directing integrates employees’ efforts: Directing integrates employee’s efforts in the organization

in such a way that every individual effort contributes to the organizational performance. Thus, it ensures that the individuals work for organizational goals. For example, a manager with good leadership abilities will be in a position to convince the employees working under him that individual efforts and team effort will lead to achievement of organizational goals.

7. Explain any three points of importance of Financial Planning.

Answer. The importance of financial planning can be explained as follows:

(i) It helps in forecasting what may happen in future under different business situations. By doing so, it helps the firms to face the eventual situation in a better way. In other words, it makes the firm better prepared to face the future. For example, a growth of 20% in sales is predicted. However, it may happen that the growth rate eventually turns out to be 10% or 30%. Many items of expenses shall be different in these three situations. By preparing a blueprint of these three situations the management may decide what should be done in each of these situations. This preparation of alternative financial plans to meet different situations is clearly of immense help in running the business smoothly.

(ii) It helps in avoiding business shocks and surprises and helps the company in preparing for the future.

(iii) It helps in coordinating various business functions, e.g., sales and production functions, by providing clear policies and procedures.

(iv) Detailed plans of action prepared under financial planning reduce waste, duplication of efforts, and gaps in planning.

(v) It tries to link the present with the future.

(vi) It provides a link between investment and financing decisions on a continuous basis.

(vii) By spelling out detailed objectives for various business segments, it makes the evaluation of actual performance easier.

8. Management by Exception, also referred to as Control by Exception is a key principle of management control. Explain how Management by Exception helps in the controlling process.

Answer. Management by Exception is a technique of analyzing the deviations. It has been established on the ground that if one attempts to control everything then it results in controlling nothing. Hence, those deviations which go beyond the allowable limit should be brought to the notice of the managers and minor or insignificant deviations can be overlooked. This saves time and energy of the managers to focus their attention on essential issues. Once identified, the deviations are analysed for their causes.

Long Answer Type Questions

9. Under the Consumer Protection Act, 2019, how are the consumer grievances redressed by the three tier machinery?

OR

What is meant by ‘Consumer Protection’? Explain the following rights of the consumers:

(i) Right to be Informed

(ii) Right to be Protected

Answer. The three-tier machinery to redress consumer grievances under Consumer Protection Act, 2019 is as follows:

(i) District Commission: When the value of goods or services along with the compensation being claimed is not more than Rs. 1 crore, then a complaint can be made to the appropriate District Commission. Moreover, any appeal against the orders passed by the District Commission can be filed before the State Commission, if the customer is unsatisfied.

(ii) State Commission: When the value of goods or services along with the compensation being claimed is more than Rs. 1 crore but less than Rs. 10 crores, then a complaint can be filed with the suitable State Commission. Moreover, any appeal against the orders of the State Commission can be filed before the National Commission if the customer is unsatisfied.

(iii) National Commission: When the value of goods and services along with the compensation being claimed is more than Rs. 10 crore, then a complaint can be filed with the National Commission. Moreover, an order passed by the National Commission in a matter of its original jurisdiction is appealable before the apex court in India i.e., The Supreme Court.

OR

Meaning of Consumer Protection: Consumer protection means the act of providing adequate protection to consumers against the unscrupulous, exploitative and unfair trade practices of manufacturers and service providers.

(i) Right to be Informed: The consumer has a right to have complete information about the product he intends to buy including its ingredients, date of manufacture, price, quantity, directions for use, etc. It is because of this reason that the legal framework in India requires the manufacturer’s to provide such information on the package and label of the product.

(ii) Right to be Protected: The consumer has a right to be protected against goods and services which are hazardous to life and health. For instance, electrical appliances which are manufactured with substandard products or do not conform to the safety norms might cause serious injury. Thus, consumers are educated that they should use electrical appliances which are ISI marked as this would be an assurance of such products meeting quality specifications.

10. What is meant by ‘Capital Market’? Explain the two segments of Capital Market.

Answer. Capital Market: Capital market includes all those organizations, institutions and instruments that provide long-term and medium-term funds through shares, bonds, debentures, etc. It consists of development banks, commercial banks and stock exchanges.

Two segments of capital market:

(i) Primary Market: The primary market is also known as the new issues market. It deals with new securities being issued for the first time. The essential function of a primary market is to facilitate the transfer of investible funds from savers to entrepreneurs seeking to establish new enterprises or to expand existing ones through the issue of securities for the first time. The investors in this market are banks, financial institutions, insurance companies, mutual funds and individuals. A company can raise capital through the primary market in the form of equity shares, preference shares, debentures, loans and deposits. Funds raised may be for setting up new projects, expansion, diversification, modernisation of existing projects, mergers and takeovers etc.

(ii) Secondary Market: The secondary market is also known as the stock market or stock exchange.

It is a market for the purchase and sale of existing securities. It helps existing investors to disinvest and fresh investors to enter the market. It also provides liquidity and marketability to existing securities. It also contributes to economic growth by channelizing funds towards the most productive investments through the process of disinvestment and reinvestment. Securities are traded, cleared and settled within the regulatory framework prescribed by SEBI.

11. Ashish, the Marketing Head; Raman, the Assistant Manager and Jyoti, the Human Resource Manager of ‘Senor Enterprises Ltd.’ decided to leave the company. The Chief Executive Officer of the company called Jyoti, the Human Resource Manager, and requested her to fill up the vacancies before leaving the organization. Informing that her subordinate Miss Alka Pandit was very competent and trustworthy, Jyoti suggested that if she could be moved up in the hierarchy, she would do the needful. The Chief Executive Officer agreed for the same. Miss Alka Pandit contacted ‘Keith Recruiters’, who advertised for the post of marketing head for ‘Senor Enterprises Ltd’. They were able to recruit a suitable candidate for the company. Raman’s vacancy was filled up by screening the database of unsolicited applications lying in the office.

(i) Name the internal/external sources of recruitment used by ‘Senor Enterprises Ltd.’ to fill up the above stated vacancies.

(ii) Also state any one merit of each of the above identified sources of recruitment.

Answer. (i) Sources of recruitment used to fill up the vacancies are:

(a) Promotion

(b) Placement Agencies and Management Consultants

(c) Casual Callers

(ii) Merit of each of the above identified sources of recruitment are :

Promotion:

(a) It helps to motivate and improve loyalty and satisfaction level of employees.

(b) It has a great psychological impact over the employees because a promotion at a higher level may lead to a chain of promotions at lower levels in the organization.

(c) It is a more reliable way of recruitment since the candidates are known to the organization.

(d) It is a cheaper source of recruitment. (Any one)

Placement Agencies and Management Consultants:

(a) They recommend only suitable candidates to their clients.

(b) It helps in enticing the needed top executives from other companies by making the right offers.

Casual Callers:

(a) It reduces the cost of recruiting workforce in comparison to other sources.

(b) It saves time.

12. The Capital of India has been declared as the most polluted city in the world. Bengaluru, Mumbai, Patna, Ahmedabad, Lucknow, Kanpur and Ludhiana are also the highly polluted Indian cities. This has resulted into a dramatic increase in the sale of home air purifiers. The prices of these devices range from ₹ 2,000 to ₹ 25,000 depending upon the type of pollutant these purifiers remove. Looking at the increasing demand of these air purifiers, ‘Pure Air Technology India Ltd.’ has developed a low cost home air purifier in its R&D Lab. The company has estimated that a commercial production of 1,00,000 units per year may cost the company ₹ 500 per unit. For this, capital of ₹ 100 crore will be required. The company decided to have both equity and debt in its capital structure. Explain any five factors that the company should consider while deciding its capital structure.

OR

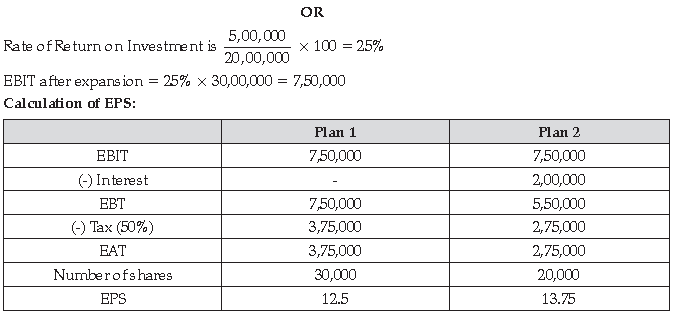

Alto Ltd. has a share capital of ₹ 20,00,000 divided into shares of ₹ 100 each. For expansion purpose, the company requires additional funds of ₹ 10,00,000. The management is considering the following alternatives for raising funds:

Alternative 1: Issue of 10,000 Equity shares of ₹ 100 each

Alternative 2: Issue of 20% Debentures of ₹10,00,000

The company’s present Earnings Before Interest and Tax (EBIT) is ₹ 5,00,000 p.a. Assuming that the rate of Return on Investment remains the same after expansion, which alternative should be used by the company in order to maximize the returns to the equity shareholders. The Tax rate is 50%. Show the working.

Answer. Following are the factors affecting the choice of capital structure of a company:

(i) Cash Flow Position: Size of projected cash flows must be considered before borrowing. Cash flows must not only cover fixed cash payment obligations but there must be sufficient buffer also. It must be kept in mind that a company has cash payment obligations for normal business operations; for investment in fixed assets; and for meeting the debt service commitments i.e., payment of interest and repayment of principal.

(ii) Interest Coverage Ratio (ICR): The interest coverage ratio refers to the number of times a company covers the interest obligation before applying taxes and interest is deducted. The higher the ratio, lower shall be the risk of company failing to meet its interest payment obligations. However, this ratio is not an adequate measure. A firm may have a high EBIT but low cash balance. Apart from interest, repayment obligations are also relevant.

(iii) Debt Service Coverage Ratio (DSCR): Debt Service Coverage Ratio takes care of the deficiencies referred to in the Interest Coverage Ratio (ICR). The cash profits generated by the operations are compared with the total cash required for the service of the debt and the preference share capital. A higher DSCR indicates better ability to meet cash commitments and consequently, the company’s potential to increase debt component in its capital structure.

(iv) Return on Investment (ROI): If the ROI of the company is higher, it can choose to use trading on equity to increase its EPS, i.e., its ability to use debt is greater.

(v) Cost of debt: A firm’s ability to borrow at a lower rate increases its capacity to employ higher debt. Thus, more debt can be used if debt can be raised at a lower rate.

(vi) Tax Rate: Since interest is a deductible expense, cost of debt is affected by the tax rate. A higher tax rate makes debt relatively cheaper and increases its attraction vis-a-vis equity.

(vii) Cost of Equity: Stock owners expect a rate of return from the equity which is commensurate with the risk they are assuming. When a company increases debt, the financial risk faced by the equity holders, increases. Consequently, their desired rate of return may increase. It is for this reason that a company cannot use debt beyond a point. If debt is used beyond that point, cost of equity may go up sharply and share price may decrease in spite of increased EPS.

Consequently, for maximization of shareholders’ wealth, debt can be used only up to a level.

(viii) Floatation Costs: Process of raising resources also involves some cost. Public issue of shares and debentures requires considerable expenditure. Getting a loan from a financial institution may not cost so much. These considerations may also affect the choice between debt and equity and hence the capital structure.

(ix) Risk Consideration: Use of debt increases the financial risk of a business. Financial risk refers to a position when a company is unable to meet its fixed financial charges namely interest payment, preference dividend and repayment obligations. Apart from the financial risk, every business has some operating risk (also called business risk). Business risk depends upon fixed operating costs. Higher fixed operating costs result in higher business risk and vice-versa. The total risk depends upon both the business risk and the financial risk. If a firm’s business risk is lower, its capacity to use debt is higher and vice-versa.

(x) Flexibility: If a firm uses its debt potential to the full, it loses flexibility to issue further debt. To maintain flexibility, it must maintain some borrowing power to take care of unforeseen circumstances.

(xi) Control: Debt normally does not cause a dilution of control. A public issue of equity may reduce the managements’ holding in the company and make it vulnerable to takeover. This factor also influences the choice between debt and equity especially in companies in which the current holding of management is on a lower side.

(xii) Regulatory Framework: Every company operates within a regulatory framework provided by the law e.g.; public issue of shares and debentures have to be made under SEBI guidelines. Raising funds from banks and other financial institutions require fulfillment of other norms. The relative ease with which these norms can be met or the procedures completed may also have a bearing upon the choice of the source of finance.

(xiii) Stock Market Conditions: If the stock markets are bullish, equity shares are more easily sold even at a higher price. Use of equity is often preferred by companies in such a situation. However, during a bearish phase, a company, may find raising of equity capital more difficult and it may opt for debt. Thus, stock market conditions often affect the choice between the two.

(xiv) Capital Structure of other Companies: A useful guideline in the capital structure planning is the debt equity ratios of other companies in the same industry. There are usually some industry norms which may help. Care however must be taken that the company does not follow the industry norms blindly. For example, if the business risk of a firm is higher, it cannot afford the same financial risk. It should go in for low debt. Thus, the management must know what the industry norms are, whether they are following them or deviating from them and adequate justification must be there in both cases.

The company should use Plan 2 in order to increase the return to the equity shareholders