Financial Markets Class 12 Business Studies Important Questions

Please refer to Financial Markets Class 12 Business Studies Important Questions with answers below. These solved questions for Chapter 12 Financial Markets in NCERT Book for Class 12 Business Studies have been prepared based on the latest syllabus and examination guidelines issued by CBSE, NCERT, and KVS. Students should learn these solved problems properly as these will help them to get better marks in your class tests and examinations. You will also be able to understand how to write answers properly. Revise these questions and answers regularly. We have provided Notes for Class 12 Business Studies for all chapters in your textbooks.

Important Questions Class 12 Business Studies Chapter 12 Financial Markets

All Financial Markets Class 12 Business Studies Important Questions provided below have been prepared by expert teachers of Standard 12 Business Studies. Please learn them and let us know if you have any questions.

Short answer types questions

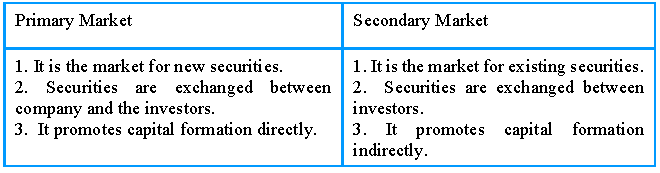

Question. Distinguish between Primary Market and Secondary Market on the basis of following point:

a. Meaning b. parties involved c. objective

Answer.

Question. Vijay Ltd. has good reputation in the market operating in the north east region. It is an exportoriented unit, dealing in exclusive handicrafts. The floods in the region have created many problems for the company. Many craftsmen and workers have been dislocated and raw material has been destroyed. The firm is therefore, unable to get an uninterrupted supply or raw material, and the duration of the production cycle has also increased. To add to the problems of the organization, the suppliers of raw material who were earlier selling on credit are now asking the company, for advance payment or cash payment on delivery. The company is facing a liquidity crisis. The CEO of the company feels that taking a bank loan is the only option with the company to meet its short-term shortage of cash. As a finance manager of the company name and explain the alternative to bank borrowing that the company can use to resolve the crisis.

Answer. Commercial Paper: It is a short term unsecured promissory note, negotiable and transferable by

endorsement and delivery with a fixed maturity period. It is issued by large and creditworthy companies

to raise short term funds at low companies that are generally considered to be financially strong

Question. ‘GS Ltd.’ is a large and credit-worthy company manufacturing cement for the Indian market. It now wants to cater to the American market and decides to invest in new hi-tech machines. Since the investment is large, it requires long-term finance. It decides to raise funds by issuing equity shares.

The issue of equity shares involves huge floatation cost. To meet the expenses of floatation cost the company decides to tap the money market.

1. Name and explain the money-market instrument the company can use for the above purpose.

2. What is the duration for which the company can get funds through this instrument?

3. State any other purpose for which this instrument can be used.

Answer. 1. Commercial paper

2. 15 days to one year

3. It can also be used for seasonal and working capital needs.

Question. The directors of a company want to expand business by making a public issue of shares. They wish to approach the stock exchange, while the finance manager prefers to approach a consultant for the new public issue of shares. Advise the directors whether to approach the stock exchange or a consultant for new public issue of shares and why. Also advise them about different methods which the company may adopt for the new public issue of shares.

Answer. The directors should approach a consultant for new public issue of shares. The stock exchanges

deal with sale and purchase of existing securities only, not in new issue of securities.

Different methods which the company may adopt for the new public issue of shares:

1. Offer through prospectus

2. Offer for sale

3. Private placement

4. Rights issue

E-IPOs

Question. Mahesh’s grandmother who was sick, called him and gave him a gift packet. Mahesh opened the packet and saw many crumpled share certificates inside. His grandmother told him that it had been left behind by his late grandfather.

As no trading is now done in physical form, Mahesh wants to know the process by adopting which he is in a position to deal with these certificates.

1. Identify and state the process.

2. Also give two reasons to Mahesh

3. why dealing with shares in physical form had been stopped.

Answer. 1. Dematerialization – It is a process where securities held by the investor in physical form are cancelled and the investor gives an electronic entry or number so that she/he can hold it as an electronic balance in an account

2. Problems with dealing in physical form –

1. Theft

2. Fake/forged transfers

3. Transfer delays

4. Paper work associated with share certificates or debentures held in physical form.

Question. Identify the method of floatation highlighted in each statement?

(a) Offer the entire new issue to Life Insurance Company?

(b) Issue of prospectus to invite public to apply for shares.

(c) Use of online system of stock exchange to issue shares.

(d) Companies Act makes it compulsory to offer new issue to existing shareholders.

Answer. a. Privaste Placement

b. Offer for sale through prospectus

c. e-ipo

d. Rights issue

Question. Ravi has 200 shares of Reliance Industries. Reliance came out with a fresh issue of shares and offers Ravi to subscribe for new shares. He was given option to buy 1 share for every two shares held by him. Name the method of issuing financial instrument. Also state which type of market trades in this type of financial instrument.

Answer. Right Issue , Primary Market

Question. The electronic book entry form of holding and transferring securities has eliminated the problems of theft and forgery. Discuss the concept indicated the given statement.

Answer. Dematerialization and correct explanation

Question. The Trading Procedure on Stock Exchange has been replaced by on-line screen based electronic trading system. This is mainly done to eliminate problems like theft, fake/forged transfers, transfer delays and paper work associated with share certificates or debentures in physical form. This is a process where securities held by the investor in the physical form are cancelled and the investor is given an electronic entry or number so that he/she can hold it as an electronic balance in an account. This has increased the equity cult among the people.

1. Identify and state the process mentioned above.

2. What is the most important requirement for the process identified in part (1)?

Answer. 1. Dematerialization – It is the process of holding securities in an electronic form.

2. ’For this, the investors has to open a ‘Demat account’ with a depository participant (DP) for holding and transferring securities in the demat form. He / She will also have to open a bank account for cash transactions in the securities market.

Long answer types questions

Question. The SEBI has imposed a penalty of Rs. 7269.5 crore on pearls Agrotech Corporation Limited (PACL) and its four directors- tarlochan singh, sukudev singh , gurmeet singh, and Subrata Bhatacharya who had mobilized funds from the general public through illegal collective investments schemes in the name of purchase and development of agriculture land. While imposing the penalty, the biggest in its history, securities and exchange boards of India said the company deserves maximum penalty for duping the common man. Its prevention of Fraudulent and Unfair Trade Practices Regulations provides for severe to severe penalties for dealing with such violation. As per SEBI norms, it can impose penalty of 25 crore or three times of the profit made by indulging in Fraudulent and unfair trade practices of the illicit gains.

In the context of the above case:

(a) State the objectives of setting up SEBI

(b) Identify the type of function performed by SEBI by quoting lines from the paragraph

Answer. A The objective of setting up SEBI is

i. To prevent malpractices in securities market.

ii. To protect rights and interests of investors,.

iii. To regulate and develop code of conduct between brokers.

iv. To regulate stock market to promote their orderly functioning.

B . Protective function is performed by SEBI

Question. Ragu works as a waiter in a five-star hotel in Mumbai. while serving the customer he overhears him at the table saying that the he has made profits higher than expected by investing in securities market. So, ragu also decides to make a nominal investment from his saving in the stock market in pursuit of higher gains:

In context of the above case:

As a financial consultant, apprise him of the steps involved in the working of a demat system.

Answer. Ragu have to initiate the following steps.

i. Open a De mat account with a depository participant who may either be a bank, broker or financial services company.

ii. If he plans to buy shares through public offer he will have to give details .on allotment of shares the shares will be credited.

iii. If he wants to buy shares otherwise, he will have to instruct his broker about the company ,no of shares etc.

iv. On contrary, whenever he wants to sell shares, he will have to instruct his broker the details like name of company, no of share share ,at what price etc.

Question. Ganesh steel ltd. is a large and creditworthy company that manufacture steel for the Indian market. It now wants to cater the Asian market and decides to invest in new Hi tech machines. Since the investment is large, it requires long term finance. It decides to raise funds by issuing equity shares.

The issue of equality shares involves huge floatation cost. To meet the expenses of floatation cost, the company decides to tap the money market.

(A) Name and explain the money market instrument that company can use for the above purpose.

(B) What is the duration for which the company can get funds through this investment?

(C) State any other purpose for which this instrument can be used.

Answer. a. Commercial papers can be used for bridge financing by Ganesh steel Ltd. as they are issued by Ganesh Steel Ltd. as they are issued by large and credit worthy companies. The instrument is in the form of unsecured promissory note and is freely transferable by endorsement. It is sold at discount and redeemed at par.

b. Its maturity period may range from a fortnight to a year.

c. It is also used to meet the term seasonal and working capital requirements of a business enterprise

Question. The stock market regulator, securities and exchange board of India (SEBI), has initiated a certification programme for all market intermediates. Under this programme, people associated with stock markets in any way, will have to obtain a qualifying certificate from the regulator. The national institute of securities market (NISM), a trust formed by SEBI, is tasked with the certification programme.

In the context of above case

(a) Identify the type of functions performed by SEBI

(b) Outline any two reasons for setting up SEBI

Answer. a. Developmental function is being carried out SEBI by starting a certification programme for all market intermediates.

B. SEBI was set up as a regulatory body by the government for the following reasons-

1. To curb malpractices in the financial market.

2. To enhance the confidence of the investors by ensuring fair, efficient and transparent dealings.

Question. These days ,the development of a country is also judged by its system of transferring finance from the sector where it is in surplus to the sector where it is needed most. To give strength to the economy, SEBI is undertaking measures to develop the capital market in which various instruments are actively traded every day .These markets together help the savers and investors in directing the available funds into better investment opportunity.

a. Name the function being performed by the market in the above case.

b. Also, explain briefly three other functions performed by this market

Answer. mobilization of funds is the function being performed by the financial market.

a) The other functions being performed are outlined below.

i. Price determination.

ii. Liquidity to financial assets

It provides common platform for exchange of securities

Question. Incorporated in 1990, Raju diary Ltd is one of the leading Manufacturers and marketers of diarybased branded foods in India. In the initial years, its operation were restricted only to collection and distribution of milk. But, over the years it has gained a reasonable market share by offering a diverse range of diary based products including fresh milk, flavoured yogurt, ice creams, butter milk, cheese, ghee etc. In order to raise the funds for its expansion plans, Raju diary Ltd. has decided to approach capital market through a mix of offer for sale of 4 crore shares and a public issue of 2 crores shares.

In context of the above case:

(A) Name and explain the segment of capital being approached by the company

(B) Identify the methods of floatation used by the company to raise the required capital. Give one difference between them.

Answer. Primary market is the segment.

a. The two methods of floatation is –issue through prospectus and offer for sale.

b. In case of issue through prospectus, the company approaches the members directly by issuing

a prospectus whereas in offer for sale through intermediaries.

Question. After doing a course in online trading, arsh started an online portal for stock trading under the name investment guru. He met his school friend Ajay after a long in a bank where Ajay had open a Demat account. Arsh urged Ajay to invest in the forthcoming IPO of a blue chip companies whereas Ajay was inclined to buy existing securities of the other companies to build his investment portfolio.

In the context above case:

(a) Identify the two difference types of capital market market being referred to by quoting lines from the para.

(b) State any four differences between the two types of capital markets as identified in part (a)

Answer. A. The two different types of capital market being referred to are-

1. Primary market Arsh urged Ajay to invest in the forthcoming IPO of a blue chip companies.

2. Secondary market: Ajay was inclined to buy existing securities of the other companies to build his investment portfolio.

B. Differences between primary market and secondary market.