Accounting for Partnership MCQ Questions Class 12 Accountancy

Please refer to MCQ Questions for Class 12 Accountancy Chapter 2 Accounting for Partnership with answers below. These multiple-choice questions have been prepared based on the latest NCERT book for Class 12 Accountancy. Students should refer to MCQ Questions for Class 12 Accountancy with Answers to score more marks in Grade 12 Accountancy exams. Students should read the chapter Accounting for Partnership and then attempt the following objective questions.

MCQ Questions for Class 12 Accountancy Chapter 2 Accounting for Partnership

MCQ Questions for Class 12 Accountancy Chapter 2 Accounting for Partnership provided below covers all important topics given in this chapter. These MCQs will help you to properly prepare for exams.

Question. Super profit can be calculated:-

(a) Average profit – Normal profit

(b) Net profit – Average profit

(c) Capital Employed –Net Profit

(d) Net Profit – Capital Employed

Answer

A

Question. In the absence of partnership deed partner share profit and loss in

(a) Ratio of capital Employed

(b) Equal Ratio

(c) 2 : 1

(d) 1 : 2

Answer

B

Question. Closing entry for interest on loan allowed to partners

(a) Interest on partner’s loan …Dr.

To Profit and Loss A/c

(b) Interest on loan …Dr.

To Profit and Loss Appropriation A/c

(c) Profit and Loss A/c …Dr.

To interest on partner’s loan A/c

(d) Profit and Loss Appropriation A/c …Dr.

To interest on loan A/c

Answer

C

Question. The Goodwill of firm Rs 1,80,000 valued at three year’s purchase of super profit . If capital employed is Rs 2,00,000 and Normal rate of return is 10% per annum .The amount of average profit will be ___________

(a) Rs 60,000

(b) Rs 20,000

(c) Rs 18,000

(d) Rs 80,000

Answer

D

Question. Goodwill is an ________ asset , but not a _______ asset

(a) Intangible , Fictitious

(b) Tangle, Fictitious

(c) Fixed, Fictitious

(d) None of the above

Answer

D

Question. A partnership firm earned divisible profit of Rs. 5,00,000, interest on capital is to be provided to partner is Rs. 3,00,000, interest on loan taken from partner is Rs. 50,000 and profit sharing ratio of partners is 5.3 sequence the following in correct way

(A) Distribute profits between partners

(B) Charge interest on loan to Profit and Loss A/c

(C) Calculate the net profit Transfer to Profit and Loss appropriation A/c IV.

(D) Provide interest on capital

(a) DABC

(b) CBAD

(c) ABCD

(d) BCDA

Answer

D

Question. A and B are partner’s sharing profit equally. A draw regularly Rs. 4,000 at the end of every month for 6 months. Year ended on 30thSeptember 2018, calculate interest on drawings @ rate 5% p.(a)

(a) Rs. 350

(b) Rs. 450

(c) Rs. 150

(d) Rs. 250

Answer

D

Question. Salary to a partner under fixed capital account is credited to

(a) Partner’s Capital A/c

(b) Partner’s current A/c

(c) Profit & Loss A/c

(d) Partner’s Loan A/c

Answer

B

Question. P, Q and R are partners in a firm. Net profit before appropriations is` 7,87,000. Total interest on capital and salary to the partners amounted to ` 40,000 and ` 75,000 respectively. P and Q are entitled to receive a commission @ 6% each on net profit after taking into consideration interest on capital salaries and all commission. Calculate commission payable to P and Q.

(a) Rs18,000 each

(b) Rs 40,320 each

(c) Rs 36,000 each

(d) Rs 24,000 each

Answer

C

Question. Sanyam, Charvi and Yuvraj are partners in a firm. Yuvraj has been given a guarantee of minimum profit of Rs 14,000 by the firm. Firm incurred a loss of Rs 6,000 during the year. Capital accounts of Sanyam and Charvi will be

(a) Rs 20,000 each

(b) Rs 7,000 each

(c) Rs 3,000 each

(d) Rs 10,000 each

Answer

D

Question. Assertion (A). In order to compensate a partner for contributing capital to the firm in excess of the profit sharing ratio, firm pays such interest on partner’s capital. Reason (R). Interest on capital is treated a charge against profit.

(a) Both A and R are individually true and R is the correct explanation of A

(b) Both A and R are individually true but R is not the correct explanation of A

(c) A is true but R is false

(d) A is false but R is true

Answer

C

Question. Match the following –

| 1. Ratio in which Partners share profit & losses before reconstitution of firm | (A) New profit sharing ratio |

| 2. Ratio in which Partners surrenders their share of profit in favour of other partners | (B) Gaining Ratio |

| 3. Ratio in which all the Partners share the future profit and losses | (C) Sacrificing Ratio |

| 4. Ratio in which Partners acquire the share from other | (D) Old Ratio |

(a) 1-D, 2-C, 3-A, 4-B

(b) 1-A, 2-C, 3-D, 4-B

(c) 2-A, 1-C, 4-D, 3-B

(d) None of the above

Answer

A

Question. Interest on partner’s loan will be credited to___________

(a) Partner’s loan account

(b) Partner’s Capital account

(c) P &L account

(d) None of the above

Answer

A

Question. A and B are the partner sharing profit in the ratio of 2.3. They admitted C as a new partner for 1/5thshare in the profit of the firm Rs. 50,000 for the year ended 31st March 2019. What will be C’s share in profit

(a) Rs. 5,000

(b) Rs. 10,000

(c) Rs. 20,000

(d) Rs. 8,000

Answer

B

Question. A and B are partners in a partnership firm without any agreement. A devotes more time for the firm as compared to (b) A will get the following commission in addition to profit in the firm’s profit –

(a) 6% of profit

(b) 4% of profit

(c) 5% of profit

(d) None of the above

Answer

D

Question. Gagandeep, a partner advanced a loan of ` 60,000 to the firm on 30th November 2020. The firm incurred a loss of ` 15,000 during the year ending 31st March, 2021. In the absence of partnership deed interest a loan allowed to Gagandeep will be

(a) Rs 3,600

(b) Rs 900

(c) Rs 1,200

(d) Rs 1,800

Answer

C

Question. A, B, and C are partner’s sharing profits in the ratio of 5.3.2According to the partnership agreement C is to get a minimum amount of Rs. 10,000 as his share of

profits every year. The net profit for the year ended 31st March, 2019 amounted to Rs. 40,000. How much amount contributed by A?

(a) Rs. 1,350

(b) Rs. 1,250

(c) Rs. 750

(d) Rs. 1,225

Answer

B

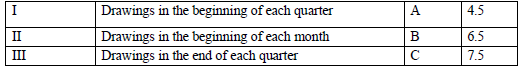

Question. If a partner withdraws an equal amount in the beginning of each month for a period of 10 months, what will be the average period for calculation of Interest on Drawings?

(a) 6.5 months

(b) 7.5 months

(c) 6 months

(d) 5.5 months

Answer

D

Question. A and B are partners sharing profits and losses in the ratio of 3.2 with capitals Rs 5,00,000 each. According to partnership deed, interest on capital is allowed @ 10%p.

(a) The profit for the year is Rs 50,000. What amount will be credited to A and B in such condition?

(a) Rs 50,000 to A and B each

(b) Rs 25,000 to A and B each

(c) Rs 30,000 to A and Rs20,000 to B

(d) None of the above.

Answer

B

Question. Charulata is a partner in a firm. She withdrew Rs.10,000 in middle of each quarter during the year ended 31st March, 2019. Interest on her drawings @ 9% p.(a) will be.

(a) Rs.1,350

(b) Rs.2,250

(c) Rs.900

(d) Rs.1,800

Answer

D

Question. Manager is entitled to a commission of 10% of the net profits after charging such commission. The net profit for the year is Rs 1,32,000. What will be the amount of manager’s commission?

(a) Rs 13,200

(b) Rs 12,000

(c) Rs 10,000

(d) None of the above.

Answer

B

Question. A and B are partners sharing profits and losses equally. They admitted C as a partner with an equal share giving him a guarantee of minimum Rs 50,000 profit p.(a) The profit for the year after C’s admission was Rs 1,20,000. What will be the net amount that will be credited to A’s Capital A/c?

(a) Rs 50,000

(b) Rs 40,000

(c) Rs 35,000

(d) Rs 80,000

Answer

C

Question. Akhil and Ravi are partners sharing profits and losses in the ratio of 7.3 with capitals of Rs 8,00,000 and Rs 6,00,000 respectively. According to partnership deed interest on capital is to be provided @ 8% p.(a) and is to be treated as a charge. Profit for the year isRs80,000. Choose the correct option.

(a) A will be credited by Rs 64,000 and B will be credited by Rs 48,000.

(b) A will be credited by Rs 56,000 and B will be credited by Rs 24,000.

(c) A will be credited by Rs 22,400 and B will be credited by Rs 9,600.

(d) A will be credited by Rs 41,600 and B will be credited by Rs 38,400.

Answer

D

Question. A and B are partners. B draws a fixed amount at the end of every month. Interest on drawings is charged @15% p.(a) At the end of the year interest on B’s drawings amounted to Rs 8,250. Drawings of B were.

(a) Rs 12,000 p.m.

(b) Rs 10,000 p.m.

(c) Rs 9,000 p.m.

(d) Rs 8,000 p.m.

Answer

B

Question. Mohit and Rohit were partners in a firm with capitals of Rs 80,000 and Rs 40,000 respectively. The firm earned a profit of Rs 30,000 during the year. Mohit’s share in the profit will be.

(a) Rs 20000

(b) Rs 15000

(c) Rs 10000

(d) Rs 18000.

Answer

B

Question. X, Y and Z are partners sharing profits and losses equally. Their capitals on March 31, 2021 are Rs 80,000; Rs 60,000; Rs 40,000 respectively. Their personal assets are worth as follows. X- Rs 20,000; Y – Rs 15,000 and Z- Rs 10,000. The extent of their liability in the firm would be.

(a) X- Rs 80,000; Y- 60,000; Z- Rs 40,000

(b) X- Rs 20,000; Y- 15,000; Z- Rs 10,000

(c) X- Rs 1,00,000; Y- 75,000; Z- Rs 50,000

(d) Equal.

Answer

B

Question. R and S are partners sharing profits in the ratio of 2.1. S has advanced a loan of Rs 1,00,000 to the firm on 1st October, 2020. The net profit earned by the firm for the year ending 31st March, 2021 is Rs 90,000. What amount will be credited to S’s capital account?

(a) Rs 60,000

(b) Rs 30,000

(c) Rs 29,000

(d) Rs 32,000.

Answer

C

Match the following –

| I | Interest on Capital | A | Cr. Side of Profit and Loss Appropriation A/c |

| II | Interest on Drawings | B | Dr. side of Profit and Loss Appropriation A/c |

| III | Interest on Partner’s Loan | C | Dr. side of Profit and Loss A/c |

(a) I-A; II-B; III-C

(b) I-B; II-A; III-C

(c) I-C; II-B; III-A

(d) I-B; II-C; III-A

Answer

B

(a) I-A; II-B; III-C

(b) I-B; II-A; III-C

(c) I-C; II-B; III-A

(d) I-B; II-C; III-A

Answer

C

Question. What is X’s share in the net divisible profit?

(a) Rs 1,24,400

(b) Rs 83,600

(c) Rs 91,200

(d) Rs 60,800

Answer

C

Question. P and Q are partners sharing profits and losses in the ratio of 2.1 with capitals Rs 1,00,000 and Rs 80,000 respectively. The interest on capital has been provided to them @ 8% instead of 10%. In the rectifying adjustment entry, Q will be.

(a) Debited by Rs 400

(b) Credited by Rs 400

(c) Debited by Rs 1600

(d) Credited by Rs 1600.

Answer

B

Question. What will be the divisible profit?

(a) Rs 5,56,000

(b) Rs 5,50,000

(c) Rs 5,52,000

(d) Rs 5,53,000.

Answer

B

Question. Net profit for the year is.

(a) Rs 10,30,000

(b) Rs 11,80,000

(c) Rs 7,30,000

(d) Rs 8,80,000

Answer

D

Question. What will be the closing capital of X after all adjustments?

(a) Rs 4,22,200

(b) Rs 4,01,400

(c) Rs 3,00,000

(d) Rs 4,23,000

Answer

B

A, B and C were partners sharing profits in the ratio of 1.2.3. Their fixed capitals on 1st April, 2020 were. A Rs 3,00,000; B Rs 4,50,000 and C Rs 10,00,000. Their partneRs hip deed provided the following.

A provides his personal office to the firm for business use charging yearly rent of Rs 1,50,000. i Interest on capitals @8% p.(a) and interest on drawings @ 10% p.(a) ii A was allowed a salary @ 10,000 per month. iii B was allowed a commission of 10% of net profit as shown by Profit and Loss account, after charging such commission.

iv C was guaranteed a profit of Rs 3,00,000 after making all adjustments.

The net profit for the year ended 31st march, 2021 was Rs 10,30,000 before making above adjustments.

You are informed that A has withdrawn Rs 5,000 in the beginning of each month, B has withdrawn Rs 5,000 at the end of each month and C has withdrawn Rs 24,000 in the beginning of each quarter.

Question. A’s rent will be shown in.

(a) Profit and loss account

(b) Profit and Loss Appropriation account

(c) A’s Capital account

(d) None of the above.

Answer

A

Question. What is the amount of Interest on capitals of X and Y.

(a) Rs 12,000 each

(b) Rs 12,000 to X and Rs Rs13,000 to Y

(c) Rs 13,000 to X and Rs12,000 to Y

(d) None of the above.

Answer

C

Question. What is the amount of commission payable to Y?

(a) Rs 15,000

(b) Rs 16,500

(c) Rs 20,800

(d) None of these

Answer

A

Question. What will be the total interest on drawings?

(a) Rs 24,000

(b) Rs 12,000

(c) Rs 36,000

(d) 48,000.

Answer

C

Question. What is the amount of interest on drawings of X and Y.

(a) Rs 1200 and Rs 1800 respectively

(b) Rs 800 and Rs 1200 respectively

(c) Rs 1200 and Rs 800 respectively

(d) Rs 1600 Rs 2400 respectively

Answer

B

Question. As per section a minor may be admitted for the benefit of the partnership if:-

(a) One partner agree

(b) More than one agree

(c) All partners agree

(d) Both (a) or (b)

Answer

C

Question. Better quality of product will increase the sales and profit. Identify the factor:-

(a) Capital Employed

(b) Efficiency of Management

(c) Location

(d) Risk

Answer

B

Question. Liability of a partner in LLP is ________

(a) limited

(b) unlimited

(c) not defined in the law

(d) limited to the capital only

Answer

A

Question. Which of the following is an artificial person recognized by law?

(a) Foundation

(b) Partnership

(c) Limited company

(d) Mosque

Answer

C

Question. If Average Profit = Rs. 1, 60,000

Actual Capital Employed = Rs. 5, 00,000

If rate of Normal Profit = 20%

What is the amount of Super Profit?

(a) Rs. 60,000

(b) Rs. 1,00,000

(c) Rs. 20,000

(d) Rs. 80,000

Answer

A

Question. The relation of partner with the firm is that of:

(a) An Owner

(b) An Agent

(c) An Owner and an Agent

(d) Manager

Answer

C

Question. Which one of the following is NOT an essential feature of a partnership?

(a) There must be an agreement

(b) There must be a business

(c) The business must be carried on for profits

(d) The business must be carried on by all the partners

Answer

D

Question. The relation of partners with the firm is that of

(a) An owner

(b) An Agent

(c) An owner and an agent

(d) Manager

Answer

C

Question. In the absence of partnership deed, partners are not entitled to receive

(a) Salaries

(b) Commission

(c) Interest on Capital

(d) All of the above

Answer

D

Question. Closing entry for interest on loan allowed to partners

(a) Interest on partner’s loan …Dr.

To Profit and Loss A/c

(b) Interest on loan …Dr.

To Profit and Loss Appropriation A/c

(c) Profit and Loss Appropriation A/c …Dr.

To interest on partner’s loan A/c

(d) Profit and Loss Appropriation A/c …Dr.

To interest on loan A/c

Answer

C

Question. Salary to a partner under fixed capital account is credited to

(a) Partner’s Capital A/c

(b) Partner’s current A/c

(c) Profit & Loss A/c

(d) Partner’s Loan A/c

Answer

B

Question. Maximum number of partners in a normal partnership are ________

(a) 5

(b) 7

(c) 20

(d) 22

Answer

C

Question. Balance of capital (fix) accounts may be

(a) Dr.

(b) Cr.

(c) Dr. or Cr.

(d) Cr. and Dr.

Answer

B

Question. Which step is not involved in valuing the goodwill according to super profit method:-

(a) Ascertain Average Profit

(b) Ascertain Super Profit

(c) Ascertain Normal Profit

(d) Multiply Super Profit with Number of years purchased

Answer

A

Question. A and B are the partner sharing profit in the ratio of 2:3. They admitted C as a new partner for 1/5thshare in the profit of the firm Rs. 50,000 for the year ended 31st March 2019. What will be C’s share in profit

(a) Rs. 5,000

(b) Rs. 10,000

(c) Rs. 20,000

(d) Rs. 8,000

Answer

B

Question. The amount of loan advanced by a partner to partnership is transferred to?

(a) Partners’ loan account

(b) Partners’ capital account

(c) Partners’ drawings account

(d) Partners’ dividend account

Answer

A

Question. Interest on Partners capital is:

(a) An expenditure

(b) An appropriation

(c) A gain

(d) None of these

Answer

B

Question. In the absence of an agreement, interest on drawings is to be charged by firm at the rate of?

(a) 5% p.a.

(b) 6% p.a.

(c) 7% p.a.

(d) None of these

Answer

D

Question. If Goodwill is Rs. 1,20,000, Average Profit is Rs. 60,000 Normal. Rate of Return is10% on Capital Employed Rs. 4,80,000. Calculate capitalized value of the firm:-

(a) Rs. 6,00,000

(b) Rs. 5,00,000

(c) Rs. 4,00,000

(d) Rs. 7,00,000

Answer

A

Question. [ A ] A business has earned Super profit of Rs. 1,00,000during the last few years and Normal rate of returns in 10% Calculate goodwill

(a) Rs. 10,00,000

(b) Rs. 54,000

(c) Rs. 20,000

(d) Rs. 36,000

Answer

A

Question. Which of the following statements is not true about the partnership form of business?

(a) A partnership is a business run by two or more persons

(b) A partnership business is easy to set up

(c) Each partner is liable under the law for the actions of other partners

(d) In the absence of agreement, partners will be paid salaries

Answer

D

Question. Which of the following forms of business would result in the termination of the business if the ownership changes?

(a) Partnership

(b) Sole proprietorship

(c) Limited liability company

(d) Both a and b

Answer

A

Question. Interest on capital is credited to

(a) Partner’s Capital Accounts

(b) Profit & Loss Account

(c) Interest Account

(d) Income Account

Answer

A

Question. Interest on capital is generally calculated on

(a) Opening capital

(b) Closing capital

(c) Average capital

(d) Normal Capital

Answer

A

Question. A and B are partner’s sharing profit in the ratio 2:1 on 31st March 2019, firm’s net profit is Rs. 86,000 the partnership deed provided interest on capital A and B Rs. 5,000 to Rs. 7,000 respectively and Interest on drawing from charged (a) Rs 1,000 per month. Calculate profit to be transferred to Partner’s Capital A/(c)

(a) Rs. 10,00,000

(b) Rs. 95,000

(c) Rs. 10,000

(d) Rs. 86,000

Answer

D

Question. If fixed amount is withdraw on the last day of every month and interest on drawing charged is 10% p.(a) Interest on drawing amounted to Rs 2,750 what will be drawing amount.

(a) Rs. 2,500p.m.

(b) Rs. 10,000p.m.

(c) Rs. 7,500p.m.

(d) Rs. 5,000 per month

Answer

D

Question. Rani and Shyam is partner in a firm. They are entitled to interest on their capital but the net profit was not sufficient for paying his interest, then the net profit will be disturbed among partner in

(a) 1 : 2

(b) Profit Sharing Ratio

(c) Capital Ratio

(d) Equally

Answer

C

Question. If the partner carries on the business that is similar to firm competition with the firm and profit earned from it, the profit

(a) Shall be retained by the partner

(b) Shall be paid to firm

(c) Can be retained or gained to the firm

(d) Both (a) or (b)

Answer

B

Question. Which one of the following item cannot be recorded in Profit and Loss Appropriation Account?

(a) Interest on Capital

(b) Manager’s Commission

(c) Interest on Drawings

(d) Partner’s Salary

Answer

B

Question. Partnership deed may be

(a) oral

(b) written

(c) duplicate

(d) either written or oral

Answer

D

Question. In a partnership, liability of all partners is

(a) unlimited

(b) limited

(c) according to capital

(d) decided by company act

Answer

A

Question. A and B are partner’s sharing profit equally. A draw regularly Rs. 4,000 at the end of every month for 6 months. Year ended on 30thSeptember 2018, calculate interest on drawings @ rate 5% p.(a)

(a) Rs. 350

(b) Rs. 450

(c) Rs. 150

(d) Rs. 250

Answer

D

Question. Which one of the following items is recorded in the Profit and Loss appropriation account

(a) Interest on Loan

(b) Partner Salary

(c) Rent paid to Partner’s

(d) Managers Commission

Answer

B

Question. A,B and C were partner in a firm sharing Profit in the ratio of 3:2:1 during the year the firm earned profit of Rs. 84,000. Calculate the amount of Profit or Loss transferred to the capital A/c of (b)

(a) Loss Rs. 87,000

(b) Profit Rs. 87,000

(c) Profit Rs.28,000

(d) Profit Rs.14,000

Answer

C

Question. Partners Current Account have

(a) debit balance

(b) credit balance

(c) debit or credit

(d) debit and credit

Answer

C

Question. When there is no partnership deed then provisions of partnership act __ willbe applicable.

(a) 1956

(b) 1912

(c) 1932

(d) 1949

Answer

C

Question. Which section of the partnership act defines partnership as the relation between person who have agreed to share the profit of the business carried on by all or any of them acting for all?

(a) Section 61

(b) Section 130

(c) Section 4

(d) Section 48

Answer

B

Question. Tangible Assets of the firm are Rs. 14,00,000 and Outside liabilities are Rs. 4,00,000, Profit of the firm is Rs. 1,50,000 and normal rate of return is 10% Calculate capital employed

(a) Rs. 10,00,000

(b) Rs. 1,00,000

(c) Rs. 50,000

(d) Rs. 20,000

Answer

A

Question. A firm had Assets of Rs 1,50,000 partner’s capital account showed a balance of Rs 1,20,000 and reserves constituted the rest . If normal rate of return is 10% per annum and Goodwill is valued at Rs48,000 at four years purchase of super profits , find the super profit of firm :

(a) Rs 6,000

(b) Rs 18,000

(c) Rs 12,000

(d) Rs 8,000

Answer

C

Question. The relation of the partner with the firm is that of

(a) An owner

(b) An agent and A Principal

(c) An agent

(d) Manager

Answer

B

Question. A, B, and C are partner’s sharing profits in the ratio of 5:3:2According to the partnership agreement C is to get a minimum amount of Rs. 10,000 as his share of profits every year. The net profit for the year ended 31st March, 2019 amounted to Rs. 40,000. How much amount contributed by A?

(a) Rs. 1,350

(b) Rs. 1,250

(c) Rs. 750

(d) Rs. 1,225

Answer

B

Question. Which of the following type of the business is governed under the partnership Act 1932?

(a) Sole-proprietorship

(b) Partnership

(c) Limited companies

(d) Unlimited companies

Answer

B

Question. A and B are partners. Their profit sharing ratio is 3: 2. Salary payable to A and B is Rs. 2,000 and Rs. 3,000 respectively. The firm’s net profit during a year is Rs. 4,000. The amount of net profit shared by A and B is:

(a) Rs. 2,000 and Rs. 2,000

(b) Rs. 2,400 and Rs. 1,600

(c) Rs. 1,600 and Rs. 2,400

(d) None of the above

Answer

C

Question. In the absence of partnership deed partners are entitled to receive

(a) Interest on Capital

(b) Interest on Loan

(c) Salary

(d) Commission

Answer

B

Question. Oustensible partners are those who

(a) do not contribute any capital but get some share of profit for lending their name to the business

(b) contribute very less capital but get equal profit

(c) do not contribute any capital and without having any interest in the business, lend their name to the business

(d) contribute maximum capital of the business

Answer

C

Question. Interest on Partner’s capital is

(a) An expenditure

(b) An appropriation

(c) A gain

(d) None of these

Answer

B

Question. If an equal amount is drawn at the end of each month for 6 months, then interest on drawing is calculated on total drawings for an average period of

(a) 3 months

(b) 2.5 months

(c) 5.5 months

(d) 7.5 months

Answer

B

Question. Fluctuating Capital Account is credited with:

(a) Interest on Capital

(b) Profit of the year

(c) Remuneration to the partners

(d) All of those

Answer

D

We hope you liked the above MCQ Questions for Class 12 Accountancy Chapter 2 Accounting for Partnership. In case you have any questions please put them in the comments box below and our teachers will provide you a response.